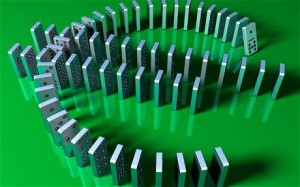

Forget about recapitalising the French Banks, saving Greece, (or the Euro)….

- Euro Dominoes

Continuing our conversation on Innovation

Yes, we admit it! The headline statement above is all about grabbing your attention. We are not advocating any disorderly default crises.

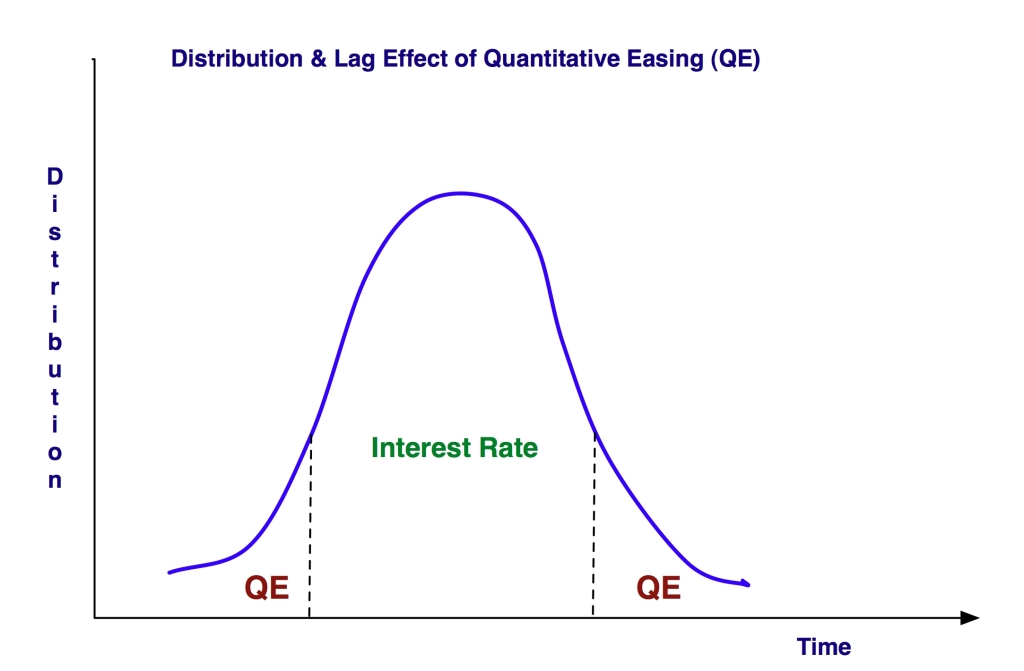

What we believe is that the ‘agricultural’ economic base and the semi-integration of Europe, via market and monetary union, without going the full circle of political and fiscal union as well, has at this point failed.

Not that a major concerted (and concentrated) effort to ensure it does not fail will end in failure itself. But has anyone really asked the question: At what financial cost?

Is he going to come and tell Germany and France in person to just let Greece go?

This reminds us of a stanza from Felix Dennis’ poem “How to Get Rich” about timing:

“Good timing? To win it

You gotta be in it.

Just never be late

To quit or cut bait.

This might just as well be the message for Europe: How not to get Poor. The key words are “Never be late to quit or cut bait”.

What we believe is happening behind the scenes is the planning for an orderly default mechanism and Euro ‘disbanding’.

The more Angela Merckel’s resolve hardens around saving the Euro, the less we believe Europeans themselves are warming to this concept.

So what about Innovation then?

We started this article with the intention of continuing our conversation on Innovation.

So, what we mean by Recapitalising Europe actually is related to addressing the culture of decay that has enveloped Europeover the last few decades. If Europe is referred to as the ‘Sick Man’, then there must be something behind that statement.

And we believe that it is the general lack of support for invigorating Europethat is a key driver.

What do you mean, we hear you ask?

In the quest to unite Europe, we have built a framework of a European parliament, a Council of Europe, a judicial system, etc.

With these institutions have come regulation, rules and edicts. Sometimes messy, sometimes helpful. But at this juncture, we are so overrun by nonsensical regulation that the will and spirit to be creative and innovative has drained away from the general citizenry.

This is a very, very sad state of affairs. The young European citizens have lost their ‘psychological contract’ with the wider Europe and European integration goal. High rates of youth unemployment across Europe is breeding a generation of disengaged European citizens and ultimately is an opportunity and efficiency waste in the medium term.

But how do we Recapitalise a spirit of Innovation in Europe?

This is a key question we are going to ask of our network and as part of our general ‘outreach series’ and report back on our progress towards establishing an Innovation Framework for Recapitalising Europe.

Please ‘tune-in’ again soon for a status and progress up date.

theMarketSoul ©2011